Nissan raises profit outlook despite supply disruptions

Nissan Motor Co. raised its annual operating profit outlook, a promising sign the automaker is still on track to climb out of the red this year despite parts shortages that have hammered production.

The Japanese carmaker raised its forecast to an operating profit of 180 billion yen ($1.6 billion) for the fiscal year through March, from 150 billion yen announced in July. Analysts are projecting, on average, 159 billion yen. For the July-September quarter Nissan reported an operating of 63 billion yen, compared with the 1.7 billion yen loss predicted by analysts.

Also check these Vehicles

Also Read : Nissan partners Zoomcar, Orix for its car subscription model

The upbeat forecast comes despite Nissan having to trim production in recent months in response to an outbreak of Covid-19 in Southeast Asia that disrupted its access to chips and other key parts. Resilient demand for cars coupled with a weaker yen are bolstering some Japanese automakers’ profitability and Nissan’s new outlook underscores confidence from the carmaker that these upside factors will continue to offset issues with its supply chain.

“The upgraded forecast is a positive surprise," said Bloomberg Intelligence analyst Tatsuo Yoshida. “The drop in incentives and fixed costs in the latest quarter was expected, but I wasn’t expecting a 70 billion yen jump in profits despite a 10% drop in sales volume."

Revenue will be 8.8 trillion yen for the fiscal year, Nissan said, compared with its prior forecast for 9.8 trillion yen and analysts’ projection for 9.4 trillion yen. Sales during the latest quarter rose 1.1% to 1.9 trillion yen. Nissan shares fell less than 1% ahead of the results. The stock is up 5.3% this year, following a 12% decline in 2020.

While continuing fallout from the pandemic and the industry-wide chip shortage are a blow to carmakers globally, they’re hitting Nissan at a difficult time. That’s being offset by a revival plan called Nissan Next, unveiled last year, focused on cutting costs and capacity and improving profitability of sales with the 12 new vehicles the automaker intends to bring to market.

Also Read : Magnite continues to be one-shot propulsion for Nissan in October

“In Nissan Next we made a commitment to prioritize value over volume and focus on profitability rather than maximizing volume," Ashwani Gupta, Nissan’s chief operating officer, said in a briefing Tuesday. Nissan will announce more details about its long-term plans, including on batteries and electrification, on Nov. 29, he added. “You can see definitive progress here."

Nissan lowered its global sales target to 3.8 million vehicles from a previous forecast of 4.4 million. Though falling each month in the July-September quarter from a year earlier, Nissan’s unit sales are up 4.1% this fiscal year through September. Global production is up 3% from a year earlier.

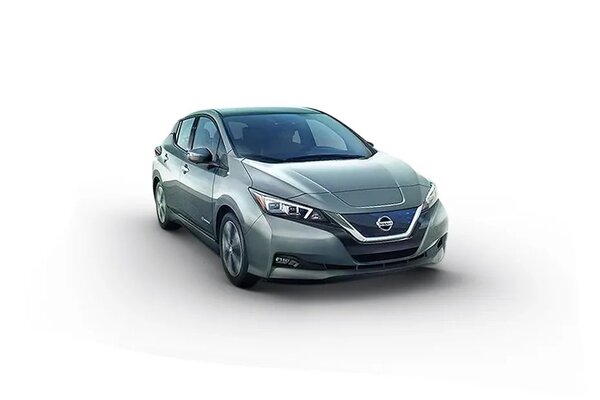

Parts shortages are causing delays in Nissan’s rollout of new models such as its flagship electric vehicle, the Ariya. The company warned earlier this year it’s expecting to lose about 500,000 units of production this fiscal year due to the ongoing chip shortage. As of July, Nissan was aiming to recover around half of that lost output in the second half. But since then, Nissan, like other Japanese automakers, has been “greatly impacted" by shortages of other automotive parts as well, Chief Executive Officer Makoto Uchida said in a recent interview.

Also Read : Waiting for Nissan Magnite SUV? Here is why your wait may get longer

At the same time, production cutbacks paired with resilient demand for cars in core markets such as the U.S. are helping to bolster Nissan’s profit margins, along with a weaker yen that’s boosting profits brought back home. With supply unable to keep up with demand, incentives are falling and used-car prices are skyrocketing. Cost-cutting efforts are also helping offset losses elsewhere and Nissan’s on track this year to reach the 2% operating profit margin target it laid out in its turnaround plan, Uchida said in September.

Still, while strong underlying consumer demand for cars is lifting all boats, with parts shortages crimping production, sales may also be constrained going forward, S&P Global Ratings corporate ratings director Katsuyuki Nakai said in a recent briefing. Considering the relative strength of Nissan’s profitability “a delay of sales recovery is a risk factor," he said.

1498.0 cc

1498.0 cc Diesel

Diesel