Tata Motors to withdraw ₹1,000 crore NCD issue due to tight market condition

Tata Motors on Thursday said it has decided to withdraw the non-convertible debenture (NCD) issue to raise up to ₹1,000 crore, due to "tight market conditions".

On May 5, the company said a board-constituted committee had approved raising up to ₹1,000 crore through issue of non-convertible debentures on a private placement basis.

"We hereby inform that the company has decided to withdraw the issue for private placement of unsecured NCDs in view of the higher cost expectations from the market participants due to the tight money market conditions," Tata Motors said in a regulatory filing.

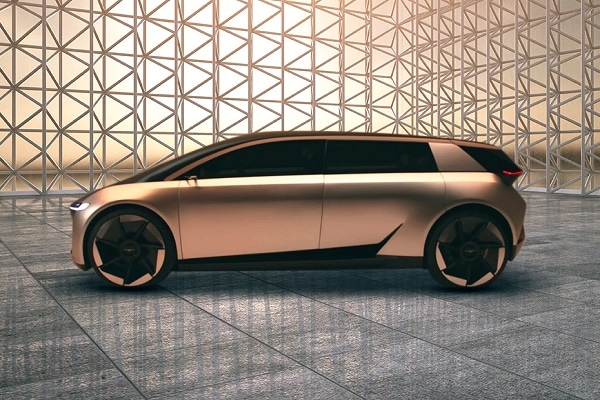

Also check these Vehicles

The company continues to have sufficient liquidity and would consider issuance of NCDs at an appropriate time and under normalised market conditions with necessary approvals, it added.

The board-constituted committee had approved the offer for subscription, on a private placement basis, up to 10,000 rated, listed, unsecured, redeemable, non-convertible debentures (NCDs) of a face value of ₹10,00,000 each at par aggregating up to ₹1,000 crore.

The company had planned to issue the NCDs in three tranches of ₹500 crore, ₹300 crore and ₹200 crore with redemptions due on September 30, 2022, November 28, 2022 and December 29, 2022 respectively.

1497 cc

1497 cc Multiple

Multiple

500 km

500 km