Goldman cuts Tesla and makes GM a buy on better sales outlook

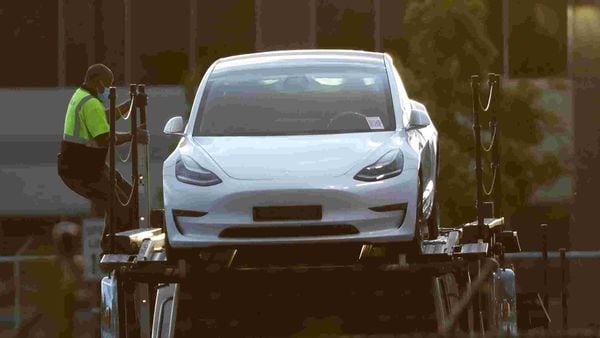

- Tesla may struggle with production challenges with Model Y while recovery in pickup sales in the US stand to benefit GM.

Goldman Sachs analysts downgraded Tesla Inc. after the stock overshot their price target and bumped General Motors Co. up to a buy on a brighter outlook for global auto sales.

While Goldman analysts led by Mark Delaney remain positive on Tesla for the long term, recent price cuts and production challenges with the new Model Y crossover cloud the electric-car maker’s intermediate outlook. GM is meanwhile well positioned to take advantage of buoyant US pickup sales and China’s recovering auto market.

Also check these Vehicles

Delaney cut Tesla to the equivalent of a hold while raising his price target to $950, below the stock’s $972.84 closing price on Thursday. He raise his target for GM, which finished at $26.50, to $36.

Goldman now expects global auto sales to drop 14.5% this year rather than 17%, with demand in the US and Europe holding up better than previously anticipated. The analysts’ projection for China sales already was higher than consensus.

75 kWh

75 kWh 396 km

396 km

2596.0 cc

2596.0 cc Diesel

Diesel