Explainer: What negative crude future mean for consumers

- Supply of fuel has been far above demand since the coronavirus forced billions of people to stop traveling.

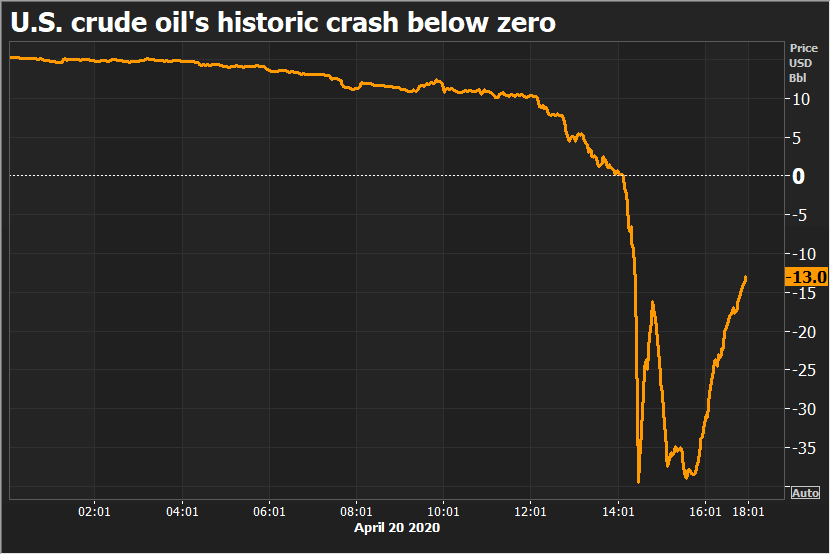

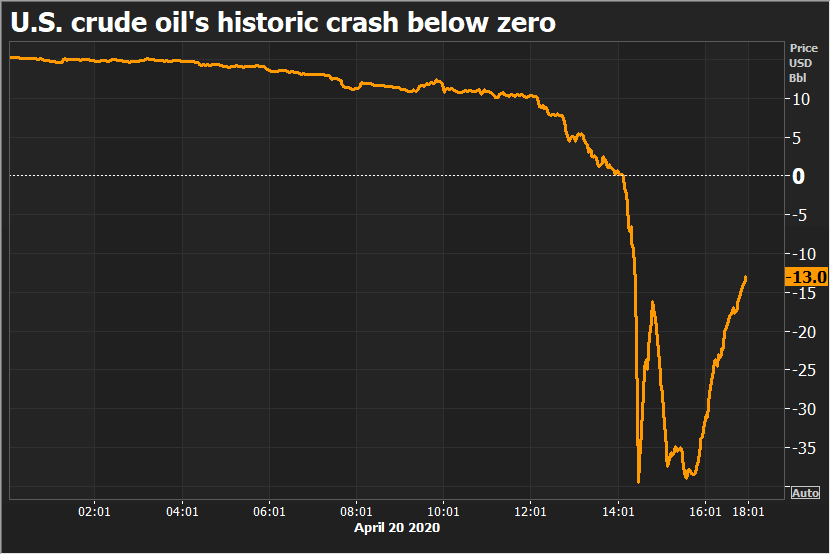

The price of a barrel of benchmark U.S. oil plunged below $0 a barrel on Monday for the first time in history, a troubling sign of an unprecedented global energy glut as the coronavirus pandemic halts travel and curbs economic activity.

The contract for West Texas intermediate crude, or WTI, is the benchmark for U.S. crude oil prices. On Monday, it looked like this:

Such a steep drop in the oil benchmark prompted strong reactions beyond trading floors. Even domestic doyenne Martha Stewart tweeted about it.

Also check these Vehicles

Here is an explanation of what negative crude prices mean in the real world:

WHAT DOES A NEGATIVE FUTURES PRICE MEAN?

The price of a barrel of crude varies based on factors such as supply, demand and quality. Supply of fuel has been far above demand since the coronavirus forced billions of people to stop traveling.

Because of oversupply, storage tanks for WTI are becoming so full it is difficult to find space. The U.S. Energy Information Administration said last week that storage at Cushing, Oklahoma, the heart of the U.S. pipeline network, was about 72% full as of April 10.

"There's no available storage anymore so the price of the commodity is effectively worthless," said Bob Yawger, director of futures at Mizuho in New York. "So when it's minus a dollar, they'll pay you a dollar to get it out of there."

The price plunge was partly due to the way oil is traded. A futures contract is for 1,000 barrels of crude, delivered into Cushing, where energy companies own storage tanks with roughly 76 million barrels of capacity.

Each contract trades for a month, with the May contract due to expire on Tuesday. Investors holding May contracts didn't want to take delivery of the oil and incur storage costs, and in the end had to pay people to take it off their hands.

The June contract, with delivery a month away, is still trading at above $20 a barrel, but the price crash indicates that most storage space has been gobbled up.

WHAT DOES THIS MEAN FOR CONSUMERS?

The crash in crude futures prices at Cushing won't necessarily translate into a crash in prices at the gas pump, said Tom Kloza, a veteran analyst with Oil Price Information Services.

"I think it's more inside baseball," Kloza said. "We'll continue to see gasoline prices, diesel prices and jet fuel prices drift lower into May but one shouldn't conclude that we're going to see fuel given away or that we're going to match these incredible, unprecedented drops we saw in crude oil today," Kloza said.

With recent lower oil prices, the typical American family is probably going to save about $150 to $175 this month on their fuel purchases, he said.

Also Read : IOC fills strategic reserves with first shipment of crude from UAE at low rates

WHAT DOES IT MEAN FOR AIRLINES?

For cash-strapped airlines, the decline in crude prices will make it cheaper to operate flights that are already nearly empty as people remain homebound due to the coronavirus.

The plunge in crude futures also indicates that the market does not expect airlines to add back many flights to their slimmed down networks any time soon, said Raymond James analyst Savanthi Syth.

WHAT DOES IT SAY ABOUT THE ECONOMIC REBOUND?

While investors and analysts wade through the technicalities of the oil markets that contributed to the crash, others are trying to glean what it might say about the economy. As much as 30 million barrels per day - what used to be 30% of global demand - has been pumped into storage worldwide in the past two or three months.

Even if demand were to return to pre-virus levels, it would take a long time to burn off all that stored crude.

"What the energy market is telling you is that demand isn't coming back any time soon, and there's a supply glut," says Kevin Flanagan, head of fixed income strategy for Wisdomtree Asset Management, in New York.

The price of June crude contracts also dropped sharply on Monday, falling by 18.4% to $20.43 a barrel. That's a more reliable view of how traders are thinking about consumer demand for energy in the immediate future. It isn't below zero, but it is falling rapidly.

120 Kwh

120 Kwh 700 km

700 km

1497 cc

1497 cc Multiple

Multiple