Inside Nissan, a renewed push to get Renault to cut its stake

A proposal is being floated atop Nissan Motor Co. for the company to revive efforts to push Renault SA to reduce its stake in the Japanese carmaker and help balance the partnership, a person familiar with the matter said.

The plan would involve both companies cutting their cross shareholdings and would call for the carmakers to use the funds for joint technology investments that could bolster their alliance, the person said, asking not to be identified discussing confidential matters. It’s still early days for the proposal and details such as the timing of any stake sale are undecided, the person said.

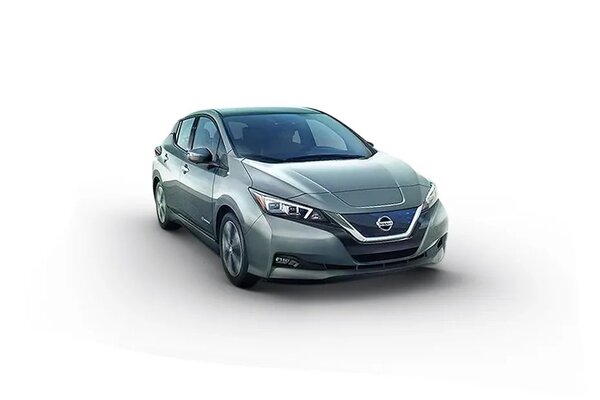

Also check these Vehicles

For Nissan, an agreement could help bring it a step closer to the independence sought by some executives who have long criticized the lopsided upper hand held by its French partner. Renault may be under more pressure to sell in the face of slumping sales, and automakers around the globe are facing a once-in-a-generation shift toward electrification and automated driving that will require billions of dollars of investments, even as they face shrinking car markets.

Jolted

Azusa Momose, a spokeswoman for Yokohama-based Nissan, said there are no plans for discussions over reducing stakes. A spokesman for Renault declined to comment and pointed to two interviews given by Chairman Jean-Dominique Senard in Davos, where he dismissed talk of shareholding changes.

Nissan and Renault’s two-decade alliance, which also added Mitsubishi Motors Corp. in 2016, was jolted by the arrest of former Chairman Carlos Ghosn in November 2018. The French automaker owns about 43% of Nissan, while the Japanese manufacturer only holds 15% of Renault and zero voting rights. Any significant changes to their shareholdings would also run the risk of raising questions over the viability of the three-way alliance.

While the asymmetrical relationship has stoked resentment in Japan, drawing down Nissan and Renault’s equity stakes in each other would ultimately strengthen the partnership through a more balanced relationship and focus on new technologies, the person said.

New CEO

The proposal comes as Renault may be preparing to appoint a chief executive officer ahead of a crucial meeting of the board governing the alliance on Thursday. The French carmaker’s board gave the green light for Luca de Meo to become the new CEO, Le Parisien reported Sunday, without saying where it got the information.

Any stake sales could free up much-needed cash for the two automakers, and also mark the first such mutual reduction since Ghosn was removed as chairman. It also risks upsetting a delicate political balance because the French government owns 15% of Renault and has sought to maintain the partnership.

Last week, Senard said changing the shareholder structure “isn’t a priority" and that the focus is on strengthening industrial cooperation. Asked whether Renault could sell down its stake in Nissan, he replied that “it’s probably not the right timing in terms of the price of the shares. It could come some day."

Makoto Uchida, Nissan’s new CEO appointed amid a year of turmoil, said last month that the partnership would have to benefit all parties and that changes were needed in the pact to benefit the companies’ sales and earnings.

Both companies are facing declining sales and shrinking profits. Nissan, which is conserving cash as it embarks on 12,500 job cuts globally, cut its dividend earlier in the current fiscal year and withdrew its outlook for a 40 yen-per-share payout. That was a blow to Renault, which in 2018 received 784 million euros ($864 million) in dividends from Nissan.

Most automakers will have to spend heavily to keep apace with the shift to electrification and automated driving. While the likes of Volkswagen AG and Toyota Motor Corp. have enough cash on hand to do so, other automakers have been seeking partnerships and raising funds to drive development.

Last week, Citigroup Inc. analyst Angus Tweedie wrote in a report that Renault’s cash strain may force it to sell some of its stake in Nissan. Investors don’t yet understand “the enormity of the challenges facing Renault, despite the shares trading at the lowest levels since 2012," said Tweedie, who downgraded the manufacturer to a sell rating.

Renault’s stake in Nissan is worth about 8.6 billion euros at the current share price and a potential disposal would be seen as a “one-off event" that would reduce earnings power and dividend, UBS analysts including David Lesne wrote in a note Monday. While they don’t see a full breakup of the alliance because “it is in the interest of both parties to keep it alive," the analysts said this would “put at risk Renault’s viability" because Nissan has contributed about 40% of Renault earnings and all its dividend.

Katsuyuki Nakai, a credit analyst at S&P Global Ratings, said any changes to the alliance that might disrupt technology sharing or cost savings would be negative for Nissan’s credit.

Renault stock fell 3.2% on Monday in Paris, reinforcing its position as the worst performer among European automakers in the past year. Nissan shares fell 28% in 2019, following a 22% decline the prior year.

Investors in the two companies have lost a combined $25 billion since the arrest of Ghosn, who shepherded their alliance for almost two decades. The 65-year-old executive, who denies the charges, escaped trial in Japan at the end of December and made his way to Lebanon, where he is living as a fugitive and vocally pressing his side of the story.

1499 cc

1499 cc Petrol

Petrol